Tracking Lines of Credit in QBO

Tracking lines of credit provides transparency, supports risk assessment, and assists in cash flow management. From an investor point of view, it is an essential practice to make informed decisions and effectively monitor portfolio.

Benefits of Tracking Lines of Credit

Keeping track of Lines of Credit (LOC) is crucial for private investors as doing so can provide valuable information. Fortunately, QuickBooks Online provides a powerful features that can streamline this process. Tracking lines of credit can be important for several reasons:

- Reporting transparency: Monitoring lines of credit provides transparency by keeping you informed about the interest paid, borrowing capacity and LOC utilization. As a private investor, this allows you to monitor borrowing activity, stay well-informed about the amount of credit utilized and available credit balances.

- Risk assessment: Tracking lines of credit allows to assess the level of debt for any corresponding investment. Tracking LOCs helps to evaluate the potential impact of debt on financial stability, cash flow, and overall likelihood of receiving targeted yields from investments.

- Cash flow management: Monitoring lines of credit increases your efficiency of managing cash flows. By having reports about how funds are being used, you may gain insights into cash flow dynamics, liquidity position, and ability to meet short-term obligations.

With QuickBooks Online you can add as many LOCs accounts as you may need. Below is a list of four easy steps required to add a new Line of Credit account in QuickBooks Online.

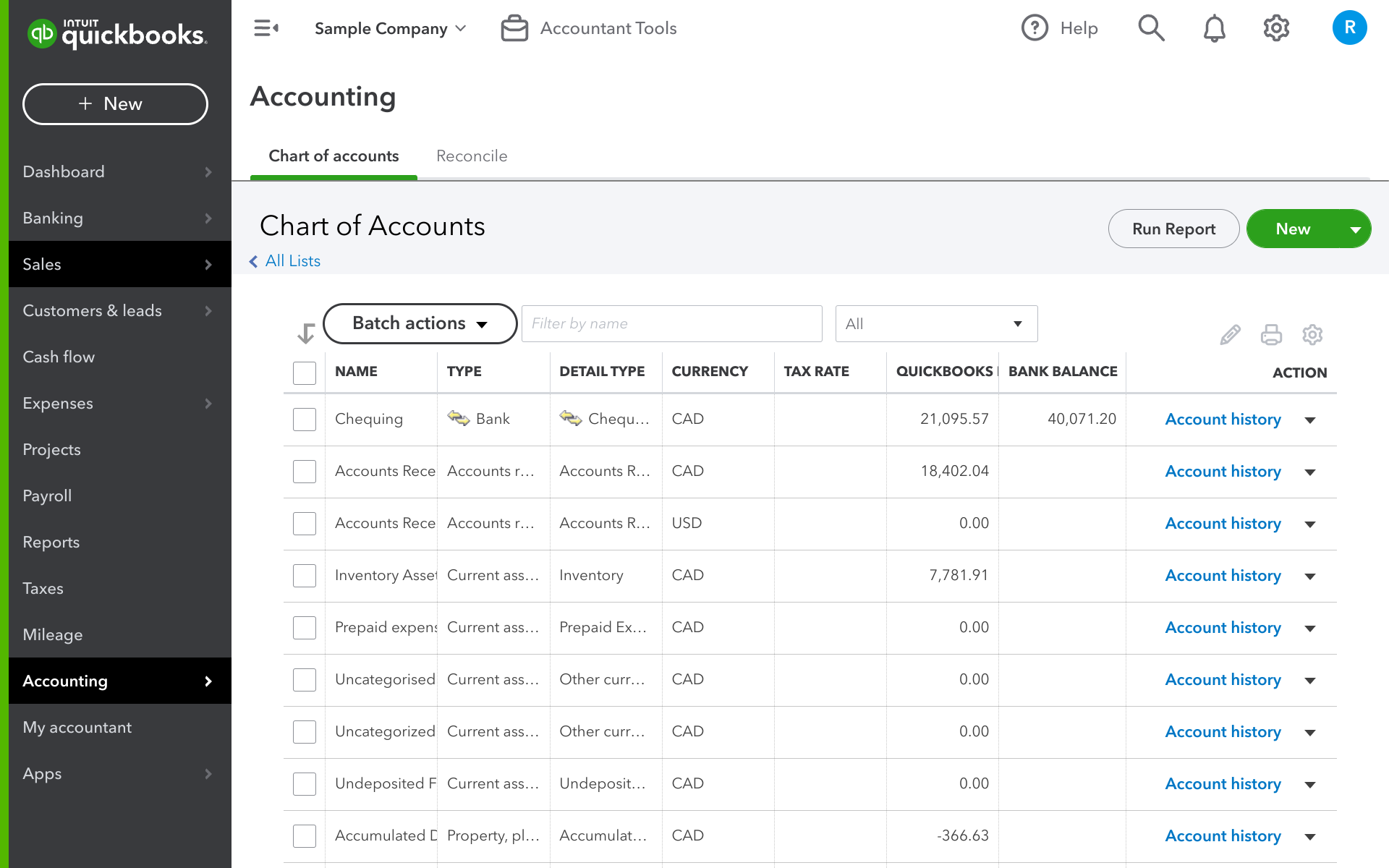

1. On a menu bar Proceed to Accounting -> Chart of accounts. It will take you to a list of all accounts. Click on a "New" button.

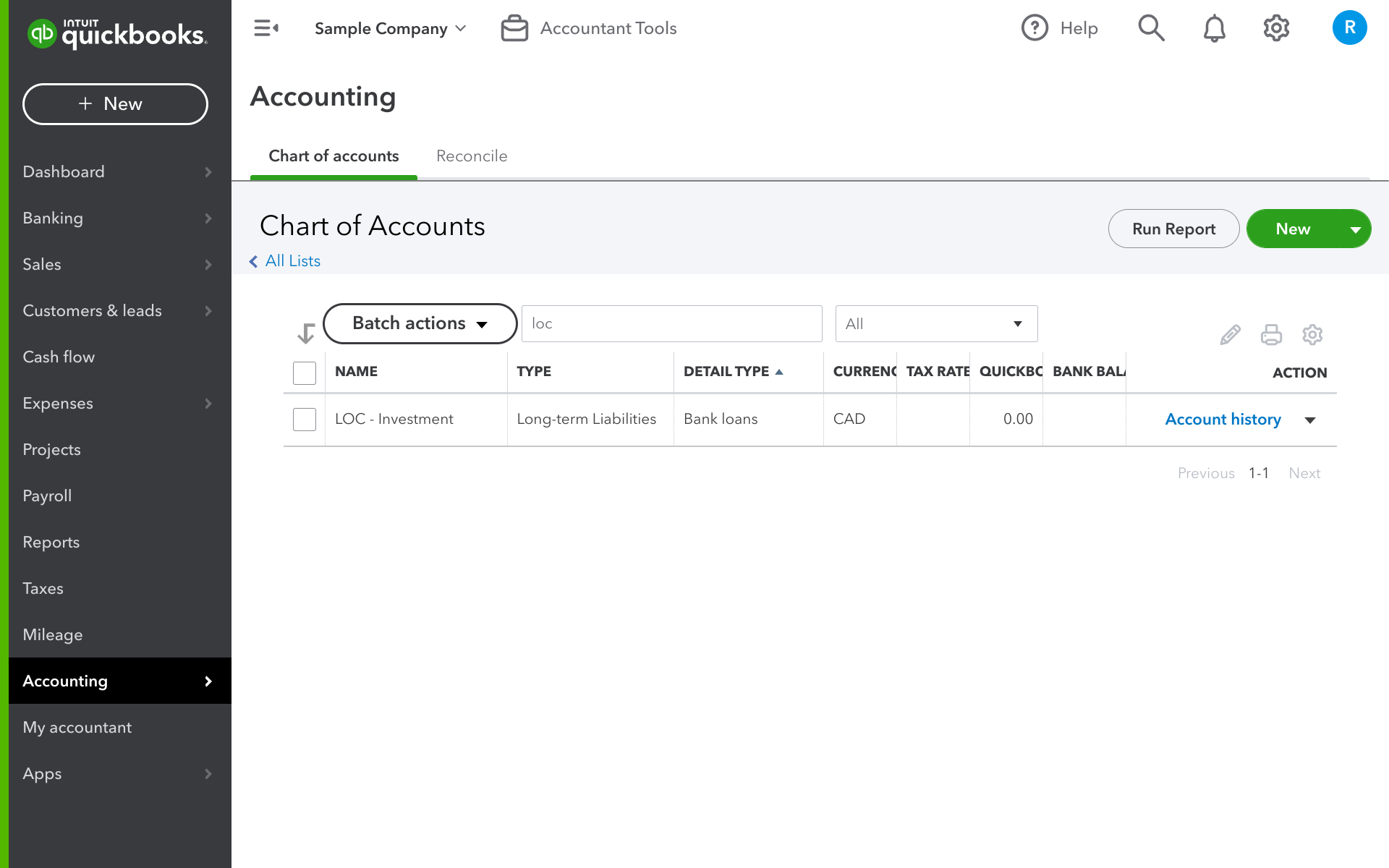

2. Select account properties from the drop-down list. Account Type is Long-term Liability; Detail type is Bank Loans; Type account name that would differentiate it from other accounts.

3. Click "Save and Close" to complete adding new account. Account for a Line of Credit is not added and ready for recording transactions.

Once all steps are completed, your Chart of Accounts will have Line of Credit new account(s) to keep track your investments.